Introduction

Being self-employed offers flexibility, independence, and the chance to build your own path. But it also comes with the responsibility of managing taxes. Unlike salaried individuals who enjoy automatic deductions at source, freelancers, consultants, and entrepreneurs must plan their finances carefully to minimize tax liabilities. The good news? There are several legitimate strategies to reduce taxable income for self-employed individuals without compromising compliance.

This guide will walk you through practical deductions, exemptions, and financial planning tips to help you save more and pay only what’s necessary.

Understanding Tax Obligations for the Self-Employed

Self-employed individuals fall under the category of “individual taxpayers” in India. They must file returns based on the income earned from professional services, freelancing, or small businesses. Taxable income is calculated after deducting eligible expenses, exemptions, and rebates. By structuring your finances smartly, you can reduce taxable income for self-employed professionals effectively.

1. Claim Business and Professional Expenses

One of the simplest ways to lower your taxable income is by deducting all genuine business-related expenses. These may include:

-

Office rent or coworking space fees

-

Internet, phone, and utility bills

-

Professional tools and software

-

Travel expenses for client meetings

-

Marketing and promotional costs

-

Salaries or payments to assistants

Maintaining proper invoices and receipts ensures these deductions are legally valid.

2. Leverage Section 80C Deductions

Section 80C of the Income Tax Act is a powerful tool to reduce taxable income for self-employed professionals. You can claim up to ₹1.5 lakh in deductions through investments such as:

-

Public Provident Fund (PPF)

-

Equity-Linked Savings Schemes (ELSS)

-

Life Insurance Premiums

-

Tax-saving Fixed Deposits

-

National Savings Certificate (NSC)

This not only helps with tax planning but also secures your financial future.

3. Health Insurance Benefits under Section 80D

Self-employed individuals often overlook health insurance benefits. Premiums paid for medical insurance qualify for deductions under Section 80D. You can claim:

-

Up to ₹25,000 for self, spouse, and children

-

An additional ₹50,000 for parents (senior citizens)

This is a smart way to safeguard your health while reducing taxable income.

4. Home Office Deductions

If you operate from home, part of your household expenses may qualify as business expenses. For example:

-

Rent proportionate to the office area

-

Electricity bills for workspaces

-

Office furniture and equipment

Documenting these properly allows you to claim them as deductions.

5. Retirement Contributions under NPS (Section 80CCD)

Contributing to the National Pension System (NPS) is another tax-efficient strategy. Under Section 80CCD(1B), you can claim an additional ₹50,000 deduction apart from the 80C limit. This not only helps in reducing taxable income for self-employed professionals but also ensures long-term retirement planning.

6. Depreciation on Assets

If you purchase laptops, cameras, or office equipment, you can claim depreciation benefits under the Income Tax Act. This allows you to spread out deductions over multiple years, making your finances more tax-efficient.

7. Donations under Section 80G

Contributions to approved charitable institutions can also be claimed as deductions. This helps reduce tax liability while supporting social causes.

8. Keep Records and File Returns on Time

Maintaining accurate financial records is crucial for self-employed individuals. Proper bookkeeping ensures you don’t miss deductions and helps avoid penalties. Filing your income tax returns (ITR) before the due date also prevents late fees and interest charges.

9. Advance Tax Payments

If your tax liability exceeds ₹10,000 in a financial year, you must pay advance tax in installments. Doing so avoids unnecessary interest under Sections 234B and 234C. Planning these payments also helps in better cash flow management.

10. Hire a Tax Consultant

While you may manage basic tax planning yourself, consulting a professional can help identify lesser-known deductions and compliance benefits. A tax advisor ensures you stay updated with the latest rules and save more effectively.

Conclusion

For freelancers, consultants, and entrepreneurs, taxes may seem overwhelming. But with the right strategies, you can reduce taxable income for self-employed professionals and keep more of your hard-earned money. By leveraging deductions, planning investments, and maintaining accurate records, you can achieve tax efficiency while staying compliant.

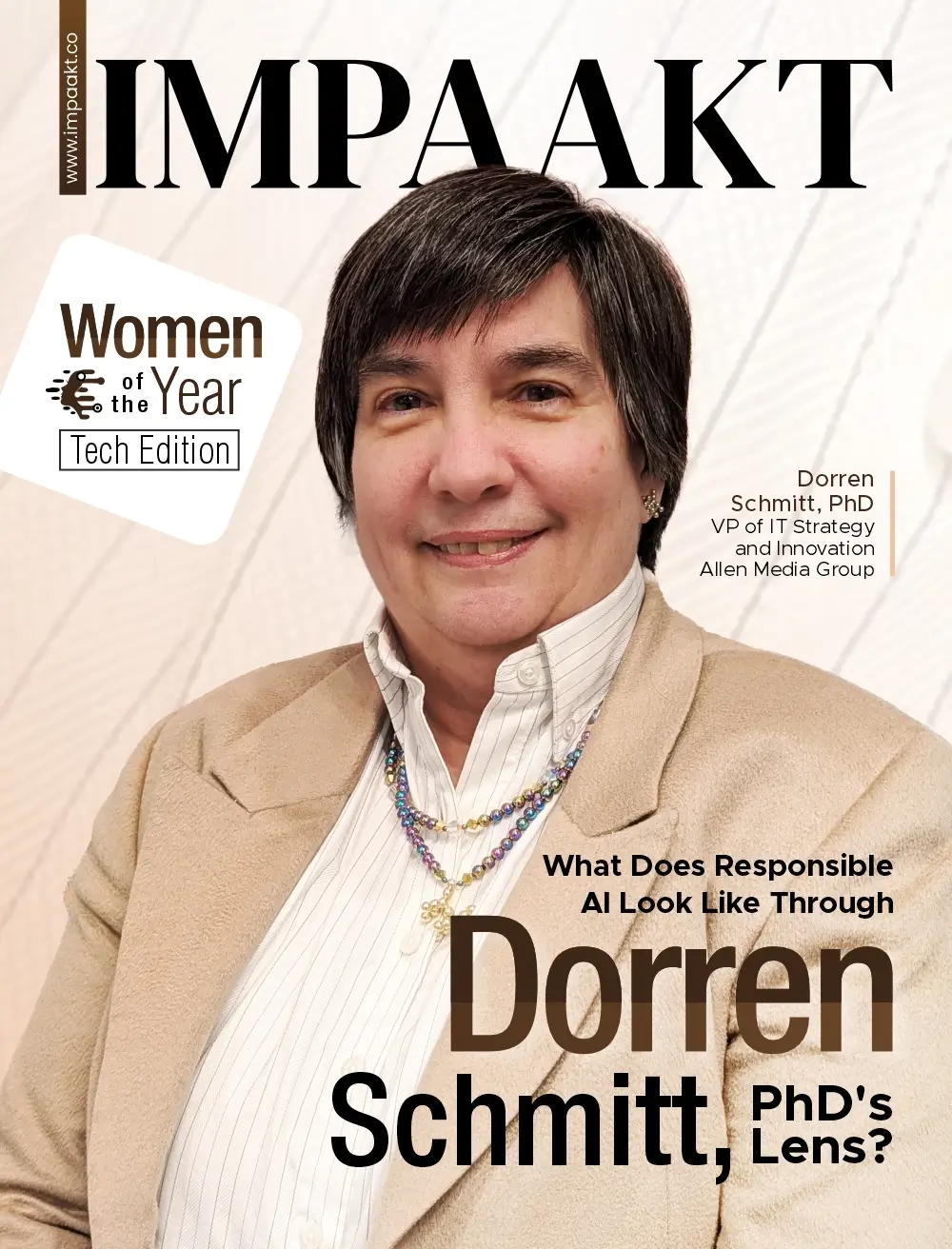

Want to stay ahead in finance, leadership, and innovation? Discover more expert insights in IMPAAKT, the top business magazine for professionals.